FTX, Probing Gently And Launching A Cashless Society

In which Sam is arrested, while the political role of a top financial regulator is cloaked

U.S. prosecutors file multiple charges from wire and securities fraud, to laundering.

Sam had declined to testify in person before Maxine Waters in Congress today.

But was willing, online. ‘A few hours later…’ his arrest in the Bahamas ensued.

SEC’s Gensler hid details of his meetings with Hillary Clinton and George Soros.

Two sets of books record public and private versions of Gensler’s 2021 calendar.

The purpose of his August meeting with Soros was disguised.

See also: Moneycircus, Nov 19, 2022 — New FTX CEO Oversaw Enron Cover Up

Nov 15, 2022 — Crisis Update - FTX, High Connections And Dark Pools

(2,850 words or about 13 minutes of your time.)

Dec 13, 2022

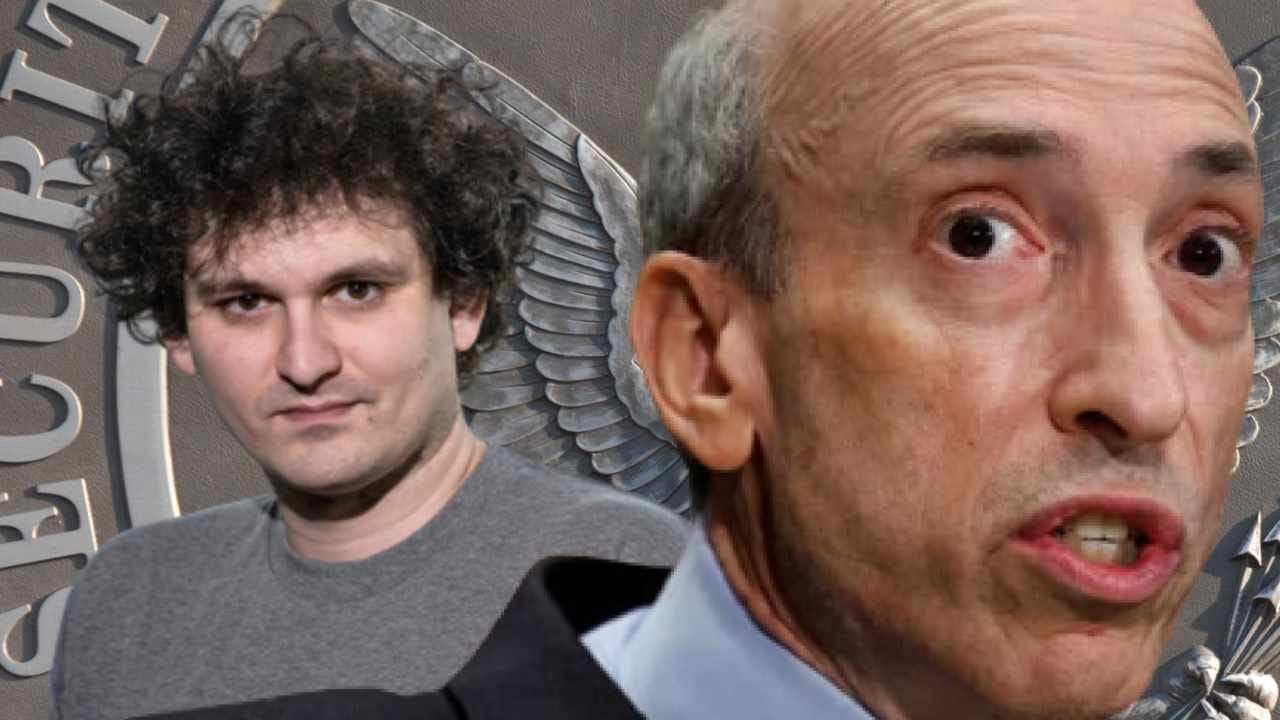

The Securities and Exchange Commission’s chairman Gary Gensler remains under the spotlight, just as much as Sam Bankman-Fried into whom the SEC has opened an investigation, after his FTX crypto exchange filed for bankruptcy on Nov 11.

Sam was to have testified today before the House Financial Services Committee chaired by representative Maxine Waters. Sam’s replacement as FTX CEO, the insolvency expert John Ray, is also due to give evidence.

In a podcast interview Sam had said that he was “overbooked” and would call in by Zoom from the Bahamas. A few hours later… as the Internet meme has it... Bahamian authorities arrested him; the country’s attorney general said he would likely be extradited to the U.S..

Central to the investigation is what happened to hundreds of millions, perhaps billions, of dollars that vanished from FTX and Alameda Research after the sister firms ceased trading.

Sam seems finally to have taken the advice of lawyers to be less garrulous on the social circuit; particularly since any comments to Congress are subject to laws of perjury.

According to charges and other reporting, Sam misled customers to deposit fiat currency in the accounts of Alameda as well as by granting Alameda a line of credit based on customer deposits at FTX. He later avoided the need to charge interest to Alameda by moving those funds — squillions of customer cash — to a third account.

The Southern District of New York charges Sam with defrauding investors from May 2019 (the founding of FTX) until bankruptcy in November 2022.

Wall Street On Parade notes that FTX acquired a retail broker registered with the SEC in Aug 2021. Originally named RJL Capital Group it was based in Staten Island, New York. Quite how crypto was to be deposited to trade stocks is unclear, especially as “neither cash nor securities will be held in the broker-dealer customer account but farmed out to other entities.” [1]

Gensler was meeting with Sam as recently as days before the collapse, on the topic of regulation of the crypto space.

The ties between Gensler, who is also an economics professor at MIT where he was a colleague of Alameda CEO Caroline Ellison’s father, have been discussed in previous articles.

The big question is how superficial or granular will be the investigation. Prosecutors may exert themselves beyond Sam’s “aw shucks” excuses but will they pursue fraud and laundering, with full disclosure of accomplices and destination?

Is there even a chance that Sam would turn state’s evidence, since that would implicate a lot of people including Gensler, possibly Maxine Waters herself, as well as his own family? Sam took selfies with Waters, who is married to Sidney Williams, formerly the United States Ambassador to the Bahamas under the Clinton Administration of 1994 to 1998.

Sam’s father Joseph, a practicing attorney and Stanford law professor appears from the timeline of video interviews to have been involved in FTX from the start so there is a possibility that Sam is not the primary source of knowledge pertaining to the brief history of FTX.

He may not be a dupe but he was not necessarily the brains. There are many other characters with “form,” including former CFTC employees and Dan Friedberg of Ultimate Bet.

On Tuesday, the SEC upped the charges against Sam, accusing him of “orchestrating a scheme to defraud equity investors” and seeking to disbar him from trading securities for life, other than for his personal ownership.

News media have voiced concern that information is being suppressed, including the identity of creditors in the Delaware bankruptcy proceedings. [2]

The U.S. Trustee Program, a sub-unit of the Department of Justice overseeing bankruptcy cases, has called for the appointment of an independent examiner.

The Trustee also noted, as did Moneycircus, that Sam was replaced by John Ray III, a former liquidator of Enron. The Trustee ask who took the decision that Ray was the man for the job? Likewise the new independent directors? The law firm Sullivan & Cromwell, long associated with finance capital and their CIA muscle, became legal advisor on the bankruptcy process, and had previously acted for both FTX and Alameda in acquisitions.

See Moneycircus, Nov 19, 2022 — New FTX CEO Oversaw Enron Cover Up

Means and motive

False flags have been used by nations through history; think tanks and military consultancies have researched how mass trauma can change public behaviour — Operation Northwoods within living memory, to the Carnegie Foundation in 1908: “Is there any means known more effective than war, assuming you wish to alter the life of an entire people?” [3]

Why should such trauma or loss not create demand to be protected by big papa government in the sphere of finance just as in physical safety? Both involve fear and loss.

A Premier League of experts failed to spot an obvious fraud, suggesting there may have been other means and motives at stake.

The financial backers of FTX included top investment managers: NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield, Insight Partners, Sequoia Capital, SoftBank, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings, BlackRock and Thoma Bravo (credit: The New York Times).

Money transferred out of FTX should have left an electronic trail: it should be traceable in the same way that the U.S. Treasury follows ordinary citizens’ investments around the world under FACTA.

Fiat currency has lost more than 90 per cent of its value during my lifetime of barely over half a century. That is one reason why Bitcoin and its crypto imitators set up shop.

The devaluation of specie may affect something deeper: society or moral values themselves. In fact, there may be a stronger link of transmission that at first seems apparent for when people confront material loss they can turn nasty.

The WEF pushes for a global -ism in which a globalist oligarchy seeks to reorder the political economy to preserve its own power. The education — even mental stability — of society is undermined by the perversion of curriculum by school boards who give every sign of working in the pay of sectional interests, and having little regard for what over centuries has been the traditional role of in loco parentis.

Big pharma and U.S. regulators failed abjectly to produce a “vaccine” that prevents transmission — instead, one that official statistics demonstrate causes more injury than all previous vaccines combined (See the CDC’s own VAERS).

All of this is evidence of spiritual and moral corruption, resulting in social degradation: inflating away moral values in a way that can only lead to depravity.

Discrediting crypto

Gensler is no Wall Street hack. He was one of the youngest-ever partners of Goldman Sachs and became an assistant secretary to the Treasury under president Bill Clinton. Someone had his back, or was pushing him forward.

His hidden “dear diary” with the Open Society founder and the top Democrat donor Soros turns out to have been a discussion of the latter’s prominent paid article in The Wall Street Journal which criticized BlackRock’s continued investment in China, while praising its Environmental, Social, and Governance (ESG) campaign.

BlackRock this year closed its biggest ESG fund launched in 2019 with effect from May. It lost an annualized rate of 17.5 per cent, compared to a sector average of +7.5 per cent. [4]

The effort, led by former governor of the central banks of Canada and England, Mark Carney, could drive companies to the wall — something he has claimed to be an objective of climate regulations.

ESGs come at the same time as the Bank for International Settlements has warned that the bulk of $100 trillion in forex swaps, of which $85 trillion are dollar-denominated, are due for refinance next year.

These forex swaps and derivatives are off balance sheet, it warns in its quarterly review of Dec 2022.

Non-banks, including companies and pension funds will need to refinance $25 trillion. Non-U.S. banks will have to refinance $35 trillion. Since they are in dollars, these swaps are held by non-U.S. companies that earn, say, in euro but pay interest payments in USD.

2023 is shaping up to be an inflection point.

Few claim to spot the routes by which this social reshaping will be achieved, nor the destination, though people may forefeit constitutional rights, including those of property and bodily autonomy, according to Klaus Schwab and the World Economic Forum.

A crucial step is to eliminate cash and to close the crypto stablecoin space. This pillar of The Great Reset is the precursor to the introduction of central bank digital currencies tied to digital identity.

One motive in orchestrating FTX as pump and dump may have been to implode a sector that was on the brink of creating a currency beyond the control of the central banks which are, remember, mostly privately owned.

Coincident with the FTX debacle, central banks are rolling out their own digital currencies: CBDCs.

There is more than one motive behind calls for a cashless society. Electronic payments allow banks, governments and big data to monitor what you buy. Abolishing notes is a move that trims costs for banks at the expense of the citizen’s privacy which is, lest we forget, closely linked to property rights.

A CBDC in contrast, is a voucher that can be tracked at every stage of exchange and turned on or off like a ration card; associated with the removal of constitutional rights of the citizen and checks on the power of government.

A further distinction is wholesale, versus retail, CBDC. The former could provide banks with a real-time settlement system that is a significant upgrade from the ticker-tape origin of the SWIFT system.

Yet a retail CBDC would mean the end of retail banking, as professor Richard Werner, author of The Princes Of The Yen (2003) has pointed out. Retail banks lend to small and mid-size businesses (SME), which in turn account for about 80 per cent of employment.

The consequences of replacing retail banks with a CBDC controlled from the centre is that it would empower families of Borgia-like feudal influence to recreate a narrow and dependent society of technical assistants and servitors.

The choice is clear:

A CBDC with no middle class or SME and thus presumably depopulation, euthanasia and eugenics.

A commercial, retail banking sector and a semblance of culture and society.

The European Union wants to limit cash purchases to below 10,000 euro. The excuse, as ever, is to fight terrorism and drugs, both of which have little if any connection to ordinary citizens.

In 2020, China launched a pilot of its digital yuan. Ukraine, Britain, Canada and many others are poised likewise. The U.S. is to launch FedNow as an instant payment system between May and July 2023. Brazil has the PIX payment system. It is already a privacy invasion.

Frigging in the rigging

There is nothing clean nor unrigged about the financial markets. It is a time-honoured rule not the exception. The bond market is finessed openly. The LIBOR interest rate scandal showed that overnight interest rates were set in a conspiracy to benefit the London-based bankers.

JP Morgan and other banks fortify silver paper, along with market makers on the COMEX like Citicorp. CFTC is the fox guarding the hen house. It failed to act on naked short selling by market maker Citadel Securities that misled ordinary investors. A petition on Change Org signed by almost 25,000 people accuses Gensler of obstruction of justice and lack of oversight for failing to intervene as per his official duty.

When you can manipulate the price downwards by selling an unlimited number shares that don’t exist, in a publicly-traded company, you can destroy the price of the underlying asset. That is market manipulation and it’s effectively legal.

When small investors fought back against the Wall Street funds in the GameStop campaign of 2021, the white shoe hedge fundafarians were outraged.

Larry Summers wrote a paper in the 1990s on Gold and Gibson’s Paradox arguing that the gold price must be manipulated lower in order keep a lid on interest rates. If financial markets don’t know of the suppression, people assume that interest rates are sufficiently high, making it easier for monetary authorities to maintain lower real interest rates. Ex post facto…

The U.S. Mint has also been in the game, its data shows it lost $111 million on shorting the silver price, over a period when the silver price was falling — so desperate or corrupt are the authorities.

Bix Weir of Road To Roota asks if there are any financial crimes nowadays that are held to account. The extreme negative level of interest rates means investors are in effect being denied a safe haven for their assets.

Pirates in port

Whole countries have been wrested of their assets. Venezuela asked for its gold to be repatriated which instead ended in the hands of Goldman Sachs, like that of Greece before. Effectively breaking the link with gold meant the Bolivar collapsed against the U.S. dollar leading to hyperinflation.

Sustainable Development Goals are an even dirtier game. A publicly held company would have to disclose in its SEC filings the impact of Climate Change on business. If deprived of credit the obvious next step is to hand over your gold, your assets — or your life.

Gensler, a former Goldman Sachs executive of 18 years, was CFO of Hillary Clinton’s campaign and would have been responsible for channeling funds to British spy Christopher Steele for his invented “pee pee dossier.”

He claims to have evolved into a proponent of market regulation, after his days at GS. Gensler is an adviser to a prominent opponent of crypto, Sen Elizabeth Warren, who also proposes reintroducing the Glass-Steagall banking restrictions. [5]

These rules, introduced after the Wall Street Crash of the 1929-1930, severely restricted banks’ access to depositors’ funds. Their scrapping under president Bill Clinton are partly blamed for the 2007-09 financial crash. [6]

Gensler became CFTC head in 2011, followed by Mark Wetjen commissioner in 2013 — who later became FTX’s U.S. head of policy and regulation. This is why Moneycircus wrote (see links below headline) that it’s incomprehensible that U.S. regulators can claim ignorance.

Sam met Gensler on several occasions as well as Goldman Sachs CEO David Solomon in Mar, 2022, who reportedly advised FTX about its discussions of regulations with the CFTC. They also discussed Goldman's assistance in taking FTX public.

Lives less charmed

The lives of others are not so charmed. Bart Chilton, a former CFTC commissioner and critic of high-frequency trading, wrote the book on investment fraud, Ponzimonium: How Scam Artists Are Ripping Off America (2015).

He supported position limits in commodities trading, exposed manipulation and alleged price manipulation in the silver market. He died in 2019 at 58. [7]

As Europe shivers, the misallocation of resources in the energy sector is revealed in its the tembling glory of its birthday suit.

The U.S. is facing another War of Independence. Brazil is facing an assault of the cartels allied to something claiming to be a version of the Socialist International, with key members of the judiciary behaving like George Soros’s tame U.S. district attorneys.

As Emanuel Pastreich tells Geopolitics and Empire the professional, political and media world has been compromised by the techniques of prostitution, incest and rape, all of which have their equivalents as a form or trauma in our public institutions. Relations are financialized and characterized by shame, denial and unspoken compliance.

The wealthy and powerful, regardless of country, have worked together through Event Covid, taking control of government at the local level where they can circumvent national sovereignty. The ubiquitous route to gain control of institutions and bureaucracy is outsourcing and privatization to information technology companies and consultants. [8]

As Tom Luongo points out, it’s telling who was not at the New York Times book deal event on Nov 30th when Sam came to speak in the Big Apple. The Davos crew was out in force: U.S. treasury secretary Janet Yellen, Ukraine’s president Volodymyr Zelenskiy, Meta’s Mark Zuckerberg — and Sam. One only needed Klaus Schwab and George Soros and it would have been the WEF crew.

But who was notable by their absence? Those who are not on board with the new global -ism: the heads of JP Morgan, Citigroup, the leaders of the Federal Reserve.

The reflex is to say, “one can only hope.” But we are beyond pleas to Fate.

See also, Moneycircus, Dec 2021 — Bankers Prance To War And Slavery

Dec 2021 — Bankers Prance To War, Part 2

[1] Wall Street On Parade, Dec 13, 2022 — Sam Bankman-Fried Quietly Bought an SEC-Registered Stock Trading Operation

[2] Wall Street On Parade, Dec 12, 2022 — No One Trusts the FTX Bankruptcy Case: News Outlets Intervene

[3] Norman Dodd, 1982 — Testimony

Moneycircus, Aug 2021 — Spies, Dupes and Charities: Rivals for Power, Part 4. Norman Dodd and the tax-exempt foundations.

[4] CityWire, March 2022 — BlackRock closes ESG fund due to lack of interest, amid poor performance

[5] CNBC, Jul 2021 — Elizabeth Warren presses Janet Yellen, regulators to address ‘growing threats’ in crypto market

[6] Politico, 2016 — Gary Gensler, Chief financial officer, Hillary for America campaign: The Wall Street apostate pushing Clinton toward financial progressivism

[7] Chris Marcus, Miles Franklin May 2021 — In Memory of Bart Chilton

[8] Geopolitics & Empire, Dec 10, 2022 — Emanuel Pastreich: COVID-19 Was a Global Coup by Private Finance, IT, & Intelligence Complexes

Outstandingly rich content, which much food for thought. Thank you.

IF FTX has government tentacles, it might be as a honey-pot operation. All BTC and crypto are by design closed-loop systems, since they require ponzi-like deposits or fraud to remove funds from the system. Any funds (and, with FTX it likely amounted to $billions) removed can be washed and most people forget that the origin of the system was on the dark web for the very reason that most (all) transactions were for nefarious means.

IF our government functioned properly, it would accept a primary role as referee of the financial system and regulate all non-ethical behavior resulting in a more stable currency and less need for alternative fiat. I would argue that the devaluation we've all experienced in USD has more to do with rewarding bad behavior (unethical bankers, money-printing FED, crony-capitalist politicians) than anything else.

BTC and crypto aren't an alternative to USD fiat and will do more harm than good, moving to a fiat that has no borders only accelerates the adoption of all things WEF...