Sep 4, 2021, Tbilisi

Tom Luongo of Gold, Goats, 'n Guns blog astutely develops an idea I also raised that the world is reshaping due in part to the slow death of the petrodollar. [1]

If you are not into the markets don’t worry. It’s not that complex. This is how I explained it:

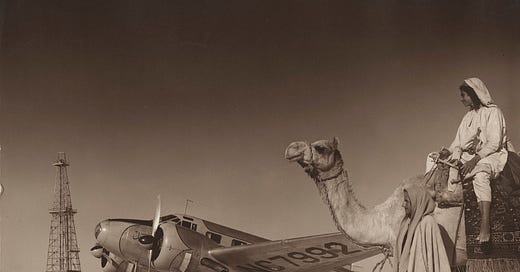

The greatest U.S. export of all is the U.S. dollar. And if you view the dollar as an export in its own right, it all begins to make sense. The U.S. economy is dependent on oil. The U.S. exports dollars to Saudi Arabia in return for oil. The deal is that the U.S. offers military protection to the Saudis in return for the Saudis lending those dollars back to the U.S. by buying U.S treasury bonds to finance American spending. Saudi has since been joined by Japan and China.

If you ever wondered why the U.S. is involved in the Mid East’s wars while it can’t end its oil-drug habit, you need to know about the secret 1974 deal that effectively wed the United States to Saudi Arabia. [2]

This makes the U.S. dollar the world reserve currency, or the base in which people prefer to hold their wealth. That gave the U.S. power over banks in every country: tp comply or die.

By combining the forces of law and banking, oversight of cash flow, patents and control of intellectual property, the U.S. financial system has the ability to launder money through almost any route in the world — with punitive sanctions for those who don’t comply.

Proposals for a new monetary system lie behind Event Covid and The Great Reset. For conformation see Greg Hunter’s 2020 interview with Jim Sinclair, listen to Dr Richard Werner and Catherine Austin Fitts.

By ending the petrodollar economy, the resource wars do not disappear, they just move to new geographies and new minerals.

Luongo points out that in financial terms the eurodollar market is bigger but the petrodollar has geopolitical significance. For more than half a century the U.S. has reacted violently to anyone trying to trade oil for other than dollars. Luongo cites Iraq’s Saddam Hussein. I mentioned Christophe de Margerie, CEO of France’s Total, who died on the tarmac at Moscow’s Vnukovo airport after talks to sell oil for gold instead of dollars.

From 2012 the U.S. Treasury took a series of measures like Christopher Marlowe’s Faustus to overreach the devil, extending oversight around the world.

It kicked Iran out of SWIFT and threatened the Swiss over bank secrecy. That, Luongo, argues, “ended an era of international finance,” destroying any illusions about who was in charge. The Swiss buckled, the Iranians did not and “forced Obama to make good on his threat. Once you uncork the nuclear weapon you can’t threaten with lesser weapons.”

Iran did deals with India and Turkey. Then China joined the party with a $280 bn contract to develop Iran’s oil, gas, and petrochemicals sector that’s since grown to $400 bn. Even Saudi Arabia has previously threatened to ditch the dollar. [3]

Russia already had multi-decade deals to supply China, while by playing contrapuntal accordion with OPEC — doing the opposite of whatever the Arabs did — which is how Russia leads the cartel by the nose.

Washington overplayed its hand but so did Riyadh. Storming the dunes to defeat Syria only to see its coalition splinter as it lost face in Yemen and Lebanon, too.

Then, on Aug 23, Saudi Arabia and Russia signed a deal on military cooperation. On the same day Turkey contracted to buy more Russian S-400 missiles. The State Department promptly reminded allies to avoid military contracts with Russia. [4]

The Saudis are under pressure at home, needing a price above $40 to support a booming welfare burden while traditional customers like India finally tire of adjusting their economy to Saudi whims. India, the world’s third-biggest oil consumer, said in May that it would start to diversify its purchases.

With oil prices above $70 the petrodollar lives to fight another day. But whose dollar is it? For now the Russians and Saudis are its guardians.

If I read Luongo correctly he argues that the Biden administration in calling for lower oil prices is not thinking of the American driving his gas-guzzler truck but “baiting out the Arab countries to de-peg their currencies from the petrodollar.”

The central bank crowd would welcome the petrodollar’s collapse to boost its flagging Great Reset as it tries to muster support for a transition to a new monetary system based not on hydrocarbon output but social credit inputs.

Slow road to China

This week’s other occasion for insight was La Repubblica’s interview with Taliban spokesman Zabihullah Mujahid in which he said Afghanistan will develop with the help of Chinese infrastructure spending.

Integration into Belt and Road is no great epiphany as I outlined this in Eurasian Notes #7 but the Italian article added detail such as plans to reopen and modernize Afghan copper mines.

Interesting that a spokesperson for the U.S. German Marshall Fund played this down, saying that Chinese investment would be small unless Taliban could guarantee stability. That’s not been an issue for U.S. oil companies in disputed corners of Iraq and neither Libya nor Syria scare off foreign oil and gas companies.

“China doesn’t do large scale aid; it will provide aid in modest terms, it will provide humanitarian assistance and it’s not going to bail out a new government,” Andrew Small told Al Jazeera. [5]

China’s investments in Africa and Asia would also seem to challenge Small’s argument but time will tell.

If the Rockefeller/United Nations smart cities programme is to advance under UN Agenda 21/2030 China will need all the minerals it can harvest for the project to proceed even glacially.

Massive shortages are already affecting current demand for semiconductors, batteries and server components that The Great Reset will require by ten times the volume.

See Also:

Great Game Over - Eurasian Notes #5 (Aug 7, 2021)

Making Sense of Taliban - Eurasian Notes #6 (Aug 22, 2021)

Afghan Squid - Eurasian Notes #7 (Aug 28, 2021)

[1] Tom Luongo, Sep 2, 2021 — Breaking the Empire Means Breaking With the Saudis

[2] Bloomberg, 2016 — The Untold Story Behind Saudi Arabia’s 41-Year U.S. Debt Secret

[3] Reuters, Apr 2019 — Saudi Arabia threatens to ditch dollar oil trades to stop 'NOPEC' - sources

[4] Southfront, Sep, 2 2021 — U.S. Could Sanction Saudi Arabia Over Defense Deal With Russia

[5] Al Jazeera, Sep 2, 2021 — Afghanistan: Taliban to rely on Chinese funds, spokesperson says