Crisis Update - Bank Runs As Pretext For Financial Lockdown

Covid was a monetary crisis - 3rd anniversary mustn't distract from present playbook

Much of the media lives in 2020, chewing the Covid cud once and again.

It’s understandable – the Covid response was cruel, inconsistent, designed to perplex.

Yet the third anniversary of the Covid pandemic sees events accelerate.

State propagandists discuss lab leaks and lockdown but are silent on army research.

They ignore Covid’s link to 15-minute cities, Agenda 2030, digital ID and rationing.

Covid was a temporary taste of lockdown; now imminent, eternal to “save” the climate.

The question is what catastrophe will serve as pretext? A banking collapse, perhaps…Locking you out of money and food until an offer you can’t refuse buys compliance?

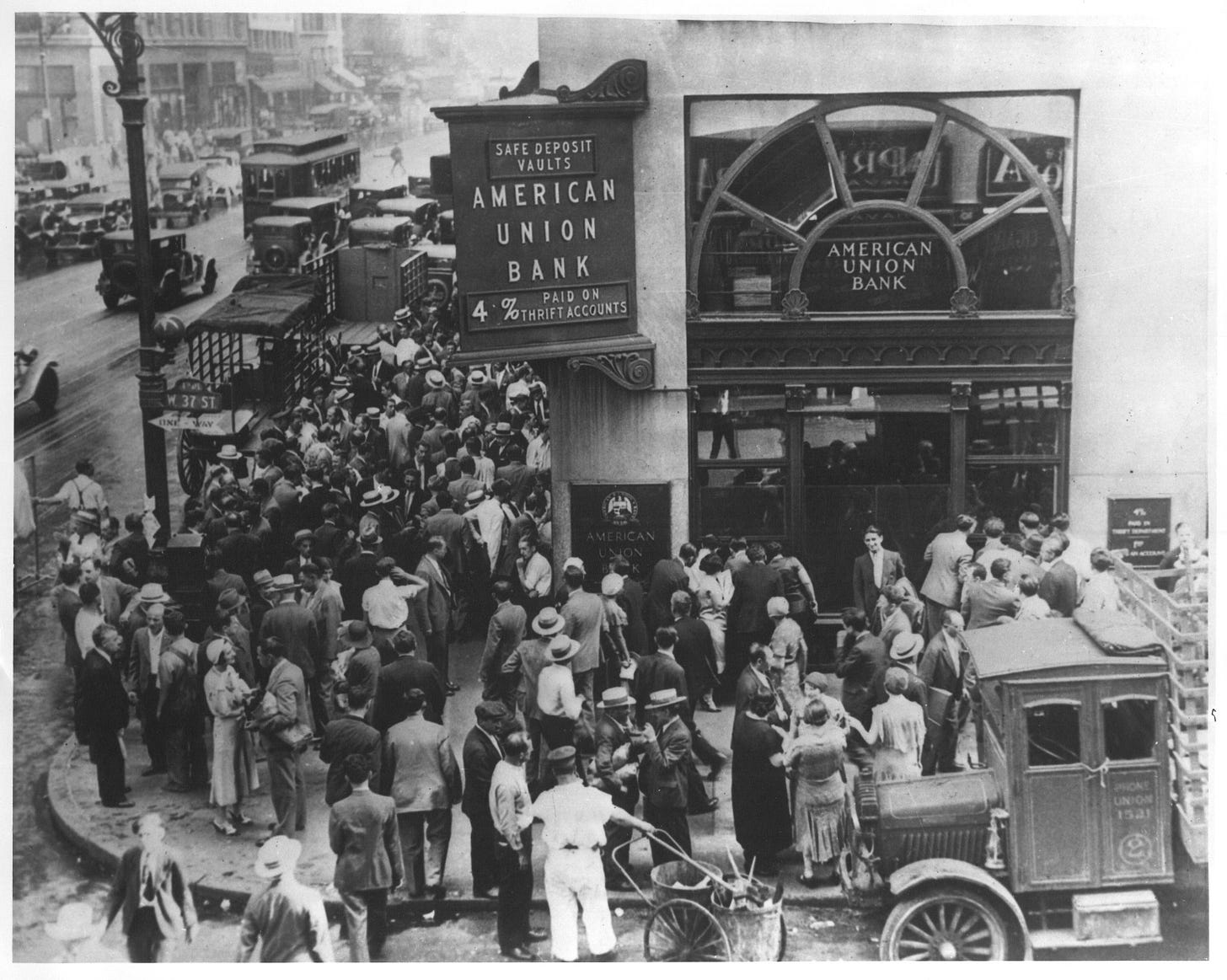

It looks like it’s happening. Californians queued outside banks after the run on SVB.

(2,900 words or about 14 minutes of your company. BTW, use the lower search bar on the home page to find more articles like this. The top “magnifying glass” searches the whole of Substack.)

Mar 12, 2023

On Friday, Silicon Valley Bank suspended withdrawals after a run on the bank. Californians queued on Saturday outside First Republic. There are fears for what Monday’s market open may herald.

Take a deep breath and pause. Remember the people who said Covid was a monetary event. The sternest warning came from professor Richard Werner, an economic expert on banks and intergovernmental institutions, and author of Princes of the Yen (2003).

Alt media types care very much who is a member of the World Economic Forum (WEF) — so Werner was a young global leader, until Klaus Schwab effectively expelled him. Like the late David Graeber, Werner holes the WEF below the waterline. He overturns all the assumptions behind which banks disguise their activities.

See Moneycircus – Not Enough Minerals For Green Energy: Colour Me Stunned. Dreams of electric everything hit reality; put the D in population (Sep 8, 2022)

No doubt the banks are in crisis. Although it seems improbable and counter intuitive, what if the Covid response was the second-worst option: to collapse society in order to save it from an even-worse collapse? For institutions and bureaucracies, remember, their own survival takes priority.

You may think that banking is an add-on, an optional extra bolted onto society, but it is the blood and arteries of a world geared to consumption fed by global supply chains — and any clot in the circulatory system can mean a stroke. At the same time, the banks have the power like a boa to constrict us.

In the autumn of 2019 banks stopped lending to each other due to a lack of trust. That froze the securities repurchase, or repo, market, by which banks lodge money with each other overnight. Financial web site Seeking Alpha in Nov 2019 wrote “how the repo crisis has multiplied like a virus through the financial system.” Its editors were unaware of their prescience.

The banks had appealed to governments for bailouts in 2008 but taxpayer money failed to plug the gap. The problem is that banks gamble with deposits, generating profits in good times but when the market plummets, they cannot return money on demand.

The asset manager BlackRock, which invests the wealth of the richest people on the planet, knew that a taxpayer bailout would not work again. It came up with a dual strategy, which it presented to the world’s leading central banks in August 2019: lock down the Main Street economy to minimise the demand for credit; and meanwhile funnel taxpayer money mostly to the biggest corporations.

This would constrict the economy, giving the banks breathing space — as the press now admits with politicians’ lockdown mea culpas — See Moneycircus: The Hancock Lockdown Limited Hangout (Mar 7, 2023)

Targeted assistance would save the big corporations, the owners, the investors, the oiler-bankers, however you define the richest and most powerful. If you doubt this was their intent, read what’s about to happen with the banks.

Depositors panic

SVB is not your average bank. It lends to tech start-ups, a market that’s been frozen for some months now as there's been less profit from share sales and initial public offerings.

It does have something in common with other banks, however, in that it’s been hit by a sharp fall in the value of bonds and U.S. Treasuries that it retains as capital to offset possible losses. Bond prices fall as interest rates rise. Just as SVB was preparing to raise funds to plug the $1.8 billion gap, depositors decided to withdraw their money: $42 billion of it.

That could happen to any bank.

The question is how banks react. In the recent past governments bailed out banks with taxpayer money. But the huge sums were not enough to stem bank losses so governments legislated bail-ins: where banks can use money from depositors and bondholders — who are unsecured creditors — to restructure their capital to stay afloat. Put simply, they can convert their debt into equity to increase their capital requirements.

Eleven countries have given customers a “haircut” including Cyprus, Ireland, Hungary and Argentina. The U.S. government could be tempted to tap $25 trillion in retirement funds. Customers from Nigeria to the U.S. have complained in the past year about money disappearing from their accounts — Bank of America, in particular.

Regulators are supposed to protect customers — the European Central Bank up to €100,000 and in the U.S. the Federal Deposit Insurance Corporation, up to $250,000.

There is, however, a class system, a caste. The rich will know of an impending collapse before the broader public.

An FDIC video leaked in January revealed what they don't want the public to know.

The recording of a November meeting of FDIC board members and bank representatives is scandalous: the bankers say only those with a “professional need to know” should be informed of the risk to the banks and deposits within them. “I almost think, you’d scare the public,” says one participant:

“If my insurance company does not tell me what they’re doing with my assets I just assume they are going to pay my claim. I think you’ve got to think of the unintended consequences of taking it public, [one] that has more faith and confidence in the banking system than maybe people in this room do [participants laugh]…

There is a select crowd of people on the institutional side and if they want to understand this they are going to find a way to understand this. There’s a bunch of law firms represented in this room and people who charge by the hour to explain this to people… I don’t have a problem with that but I would be careful about the unintended consequences of blasting this out to the general public.” [1]

Another FDIC representative spoke of waiting until Friday night to shutter banks. The response would be rather like BlackRock’s proposal: reduce Main Street’s use of money with “targeted guarantees to allay concerns about excess cash use” under Title II of the Dodd-Frank Act

The FDIC has only $125 billion in reserves, and a $100 billion line of credit, to cover $9 trillion of insured deposits. That’s 1.38 per cent of deposits covered. So although all deposits are protected, the money may not be available.

Under the FDICs proposals depositors are thus likely to be “bailed in” — as happened in Cyprus in 2018. That imposed a 70 per cent “haircut” on holders of Greek debt which wiped out a large chunk of life-savings, college funds, and pensions of thousands of Greek middle-class people.

The UK central bank even has a handy-dandy guide for stealing customers’ deposits, “Executing bail-in: an operational guide from the Bank of England.” [2]

The mechanism the FDIC would prefer is convertible long-term debt (TLAC) to seize the assets of pensioners and bondholders, to be repaid with a coupon over time. Critics say this does not offset a bail-out because governments would be under political pressure to compensate pensioners and bondholders. In other words, the banks are still bailed out, just via a more circuitous route.

There is no substitute for capital requirements, including for material subsidiaries from which banks profit. The culture of privatising profits and socialising losses has to end. Unfortunately we are where we are.

Covid as climate as monetary crisis

In March 2021 the U.S. Defense Department held a climate and environmental security tabletop exercise, Elliptic Thunder. As with pandemics this called for a whole-of-government approach (the fusion doctrine that fuses, for example, the response to mental health between police, social workers and educators).

It predicted rising competition between regional powers, and the need to build capacity and resilience, and to counter misinformation in the face of “compounding and cascading events” — the same prescription as for Covid.

See Moneycircus – Globalism, Socialism, Fascism, Feudalism (Part 1), Sep 19, 2022

The losers and beneficiaries from the Covid response, from monetary reset, and from climate lockdown are one and the same: the wealthiest owner-investors, the oiler-bankers.

If that’s the case, why do more people not seem to be aware?

Willful blindness

The alt media should not attack its own but there is a kind of morbid obsession with the plandemic itself; a curiosity akin to Munchausen syndrome that wallows in the symptoms but ignores the context, taking care not to entertain allegations of bioweapons, or even the shot very much, let alone the involvement of the Western military.

Identity theft, or stolen consciousness, you might call it.

Event Covid was impossibly complex — even with the benefit of hindsight — and, like the constantly changing rules and regulations, it was intended to confuse. Even if the coronavirus-as-common-flu soon became obvious, there were many other layers, and these were distracting and time-consuming. It was meant to be the opposite of science: impenetrable, dark (occult), ritualistic, fearful and spooky, oppressive and driving submission, of the individual to the group, of the group to the government.

Whereas Covid and its lockdown were meant to be temporary; climate restrictions and lockdown are intended to be permanent. Think about the path. We went from:

civil liberties are the bedrock of society, to

give up your liberty temporarily, to

surrender your liberty permanently to save the Earth.

Climate has additional layers:

15 minute city

personal carbon allowance

digital ID with a universal basic income

CBDC

Each sequential step works with the previous one: for example the 15 minute city gets us used to never moving more than 5km from our home. Surprise, surprise it is the same policy as the Covid quarantine.

Credit for this observation to Chris Sky, who is running for mayor of Toronto. [Some may critcise him but — worse than the incumbent politicians? — come on.] [3]

Under the UN programme each person’s yearly carbon allowance will be 2,000 kg. The current estimate for an American is 20,000 kg. A long-distance flight would use 500 kg, or a quarter of your allowance.

Each person will also pay a carbon tax on everything they buy. It will be calculated at $170 per tonne in Canada. Living at today’s lifestyle that would be an extra $3,500 a year for one person. A family of four would pay four times that, says Mr Sky.

Not surprisingly the reader can see that the super rich and their “it girls” will be able to purchase their way around these rules. For the masses a central bank digital currency, tied to one’s identity, will let bankers trace, limit and tax every single transaction.

The exempt

Someone has to implement the climate lockdown however, and the billionaires have purchased the compliance of bureaucrats.

These are the intergovernmental servants of the banking super class who already have widespread immunity from the law, including border controls, and who can travel freely all over the globe. See Corey Lynn (Corey's Diggs) and the abuse of diplomatic immunity by banks, beginning with the BIS. [4]

It is a very important piece of research. It is not wholly new information but she has detailed it down to the sub-organisations and contractors concerned.

Why do bankers (primarily) have immunity which exceeds that of diplomats (the author’s father was a British diplomat so the limits in government service are known)?

This proves, near-as-darn-it, that the Klaus Schwab Great Reset is a cover story… and that what is going on is not a philosophical mulling of quo vadis the Earth but a banal banker heist.

It would explain why governments are printing and spending money as if it is water, with no transparency on where it is going, with the expectation that they will just launch Central Bank Digital Currencies and wipe the slate clean.

Schwab might turn out to be less the Nazi scion and more of a marionette to disguise the bankers of his Swiss hideout.

Keep reading with a 7-day free trial

Subscribe to Moneycircus to keep reading this post and get 7 days of free access to the full post archives.